Cara Kira BMI Untuk Dewasa, Kanak-kanak & Ibu Mengandung

Cara kira BMI adalah penting untuk kita mengetahui berat ideal bagi ketinggian yang bersesuaian dengan dengan merujuk carta BMI.

Maka dengan berpandukan BMI, lebih mudah untuk kita meletakkan sasaran untuk memulakan diet, sama ada untuk peningkatan ataupun penurunan berat agar dapat mencapai berat badan yang unggul.

Apakah BMI?

Body Mass Index atau singkatannya BMI adalah indeks jisim badan iaitu ukuran untuk menilai berat badan anda berbanding dengan ketinggian.

Cara Kira BMI Secara Manual

Untuk mengetahui cara kira BMI, kita cuma perlukan 2 maklumat utama iaitu BERAT BADAN (dalam kg) dan KETINGGIAN (dalam meter).

Dan daripada hasil kiraan nanti kita akan merujuk pula pada carta BMI untuk mengetahui sama ada normal, kurang berat, lebih berat badan atau obes.

Ringkasnya, cara kira BMI secara manual adalah dengan menggunakan formula ini:

FORMULA KIRA BMI

BMI = Berat (kg) / ketinggian (m)²

Contoh Pengiraan:

- Berat Badan = 70kg

- Tinggi = 165cm = 1.65M

- Maka, BMI = 70kg / (1.65m x 1.65m) = 25.7

*Lihat carta BMI di bawah untuk ketahui kategori berat badan ideal

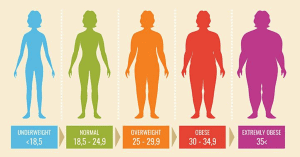

CARTA BMI (Dewasa)

Jika BMI anda kurang daripada 18.5kg/m², anda adalah kurang berat badan.

Anda adalah berlebihan berat badan jika BMI anda adalah 25 hingga kurang dari 30 kg/m². Jika BMI anda adalah 30 atau lebih, anda adalah obes.

| Jika BMI anda (kg/m²) adalah : | Anda adalah : |

| < 18.5 | Kurang berat badan |

| 18.5 – 24.9 | Mempunyai berat badan unggul |

| 25 – 30 | Berlebihan berat badan |

| 30 atau lebih | Obes |

*Nota :

Carta BMI di atas ini hanya sesuai untuk individu dewasa yang berusia antara 18 hingga 65 tahun.

Bagi warga emas, kanak-kanak, dan ibu mengandung, cara kira BMI adalah sama namun carta BMI yang perlu dirujuk adalah berbeza.

Baca juga : eKasih 2020: Semakan Status Pendaftaran & Penerima Bantuan

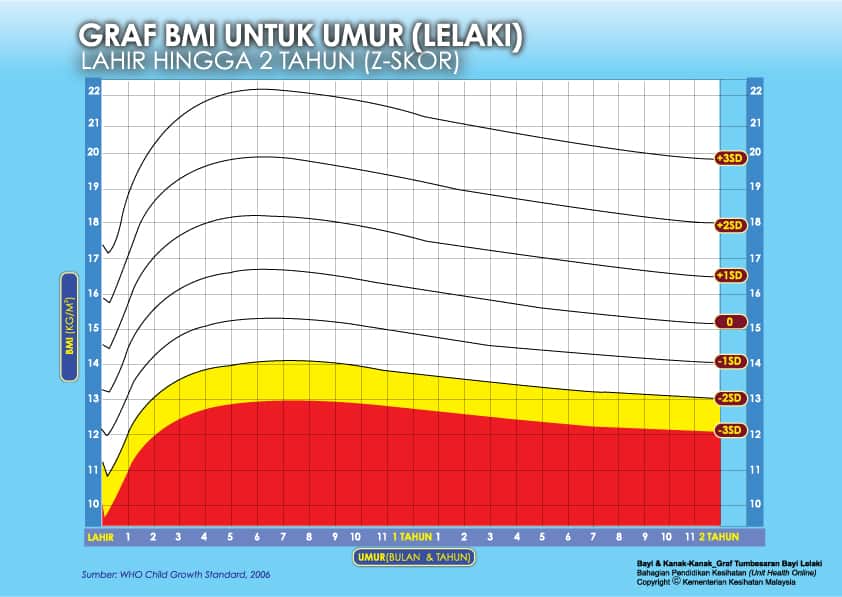

Cara Kira BMI Kanak-kanak

Cara kira BMI bayi dan kanak-kanak adalah sama dengan dewasa, namun carta rujukannya adalah berbeza.

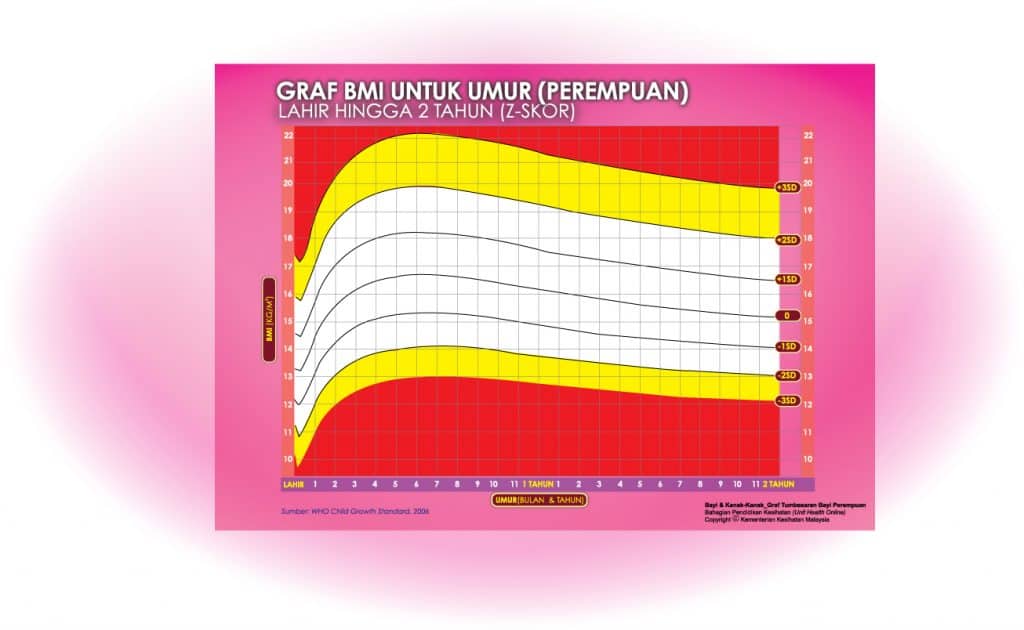

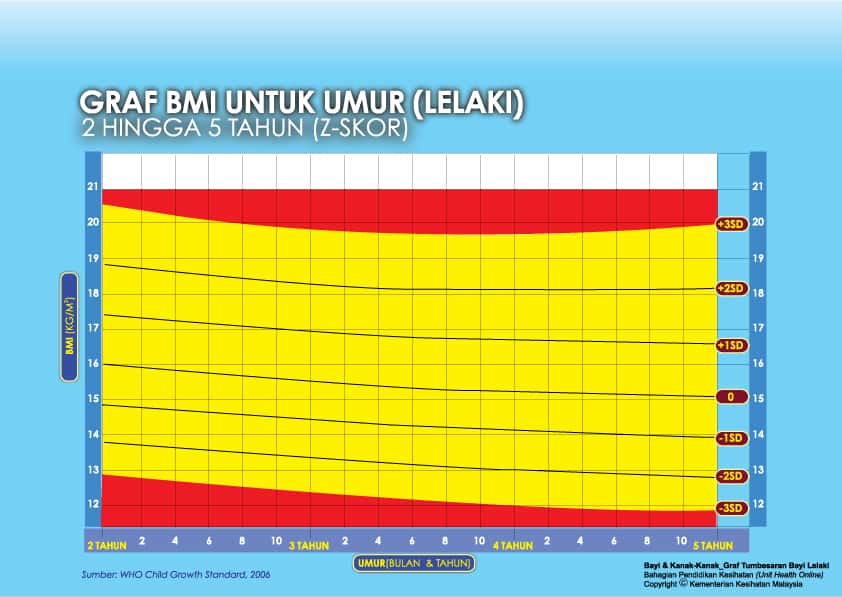

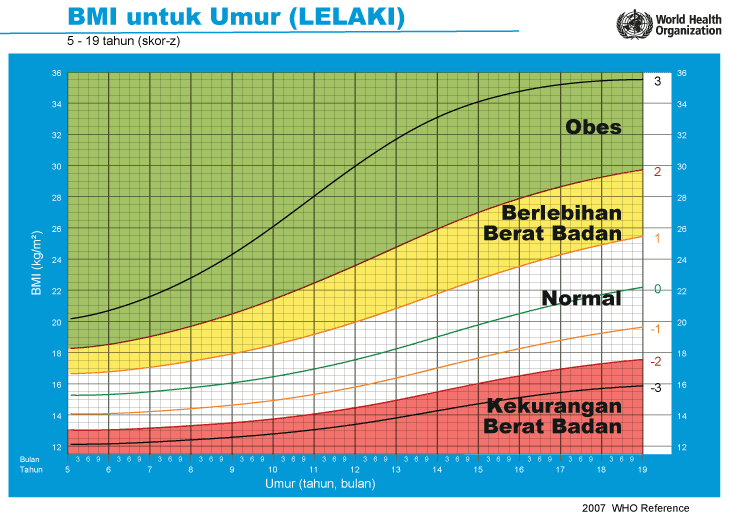

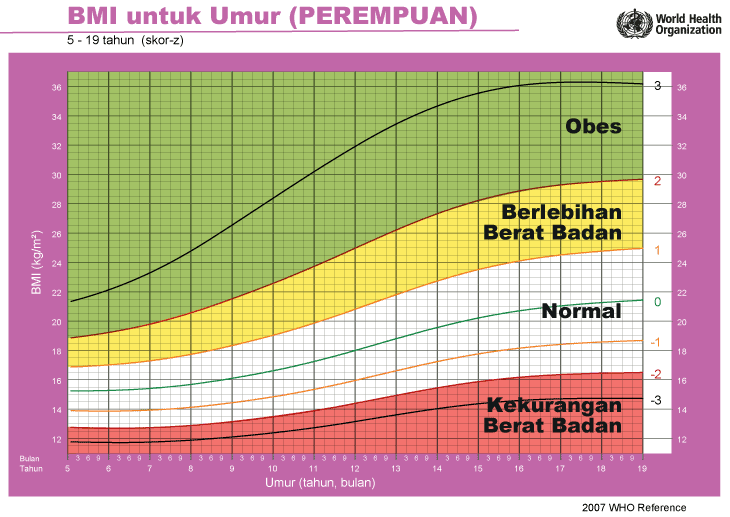

Berikut adalah carta pertumbuhan bayi dan kanak-kanak yang boleh dirujuk untuk melihat tahap kesihatan mereka berdasarkan Graf BMI bayi dan kanak-kanak oleh Kementerian Kesihatan Malaysia (KKM).

i) Graf BMI Bayi 2 Tahun Ke Bawah

Setiap carta rujukan pertumbuhan mempunyai kawasan berlainan yang menunjukkan kategori BMI anak anda:

- Jika BMI anak berada pada kawasan merah carta – ‘berlebihan berat badan’ / ‘kekurangan berat badan’

- Jika BMI anak berada pada kawasan kuning carta -‘berisiko berlebihan berat badan / kekurangan berat badan’

- Jika BMI anak berada pada kawasan putih carta – ‘berat badan normal’

ii) Graf BMI Kanak-kanak 2 Tahun Hingga 5 Tahun

iii) Graf BMI Kanak-kanak & Remaja (5-19 Tahun)

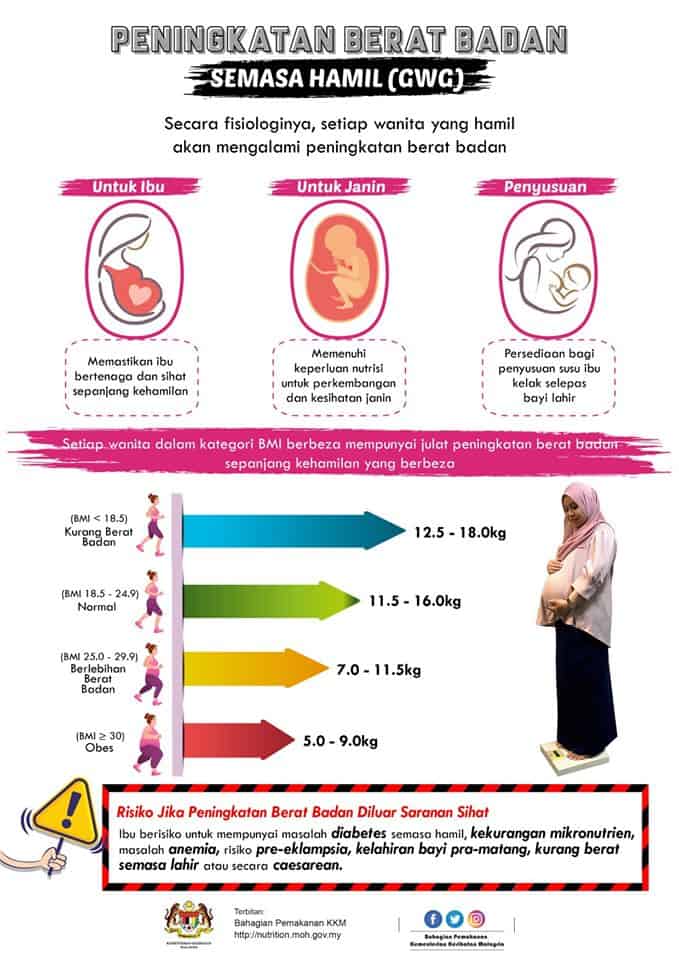

Cara Kira BMI Ibu Mengandung

Wanita yang hamil akan mengalami penambahan berat badan yang sihat ketika mengandung.

Penambahan berat badan semasa hamil adalah berbeza bagi setiap wanita.

Kita boleh merujuk carta BMI ibu mengandung yang disarankan oleh KKM di bawah ini untuk memantau dan mengawal berat badan anda dengan lebih mudah.

- Wanita dengan berat badan normal (BMI dari 18.5 – 25) akan mengalami pertambahan kira-kira 11.5kg hingga 16kg ketika hamil

- Wanita yang kekurangan berat badan (BMI <18.5) perlu mendapatkan lebih banyak berat, iaitu dari 12.5kg hingga 18kg.

- Wanita yang mempunyai berat badan berlebihan (BMI> 25) sepatutnya tidak mengalami pertambahan berat badan yang banyak, iaitu dari 7kg hingga 11.5kg sahaja.

- Wanita yang obes (BMI> 30) pula disarankan mengurangkan pertambahan berat badan kepada 5kg hingga 9kg sahaja.

Penambahan berat badan mengikut minggu (digunakan untuk wanita hamil dengan purata BMI dari 18.5-25):

- Minggu 1 hingga minggu 12 (trimester pertama): 0.9 hingga 2 kilogram

- Minggu 13-26 (trimester kedua): 4 hingga 5 kilogram

- Minggu 27-40 (trimester ketiga): 5 hingga 6 kilogram

Baca juga : iSuri KWSP: Daftar & Semak Status Kelayakan Bantuan Suri Rumah

Apakah Keistimewaan Mempunyai Berat Badan Unggul?

Anda mempunyai berat badan unggul sekiranya BMI anda adalah di antara 18.5 hingga 24.9/km².

Kajian menunjukkan bahawa jangka hayat seseorang yang mempunyai BMI unggul adalah lebih tinggi daripada seseorang yang mempunyai BMI yang lebih rendah atau tinggi.

Cara Mencapai Berat Badan Unggul Secara Realistik

Menurut Portal MyHealth, berikut adalah antara cara realistik yang boleh dilakukan untuk mencapai berat badan unggul:

- Tetapkan sasaran yang realistik untuk menurunkan setengah kilogram berat badan dalam seminggu.

- Pastikan keperluan tenaga anda.

- Timbang berat badan anda sekali seminggu, sebaik- baiknya sebelum makan.

- Makan makanan yang sihat secara sederhana berdasarkan Piramid Makanan Malaysia.

- Jangan sekali-kali menyekat diri untuk tidak makan atau mengehadkan kalori jika anda sangat lapar. Jika anda berbuat demikian, anda selalunya akan makan mengikut nafsu selepas itu.

- Buat beberapa modifikasi dalam diet anda.

- Kurangkan atau elakkan makanan yang tinggi kandungan gula dan lemak seperti mentega,krim, daging yang berlemak, sos salad, kek dan pastri.

- Elakkan makan atau minum semasa menonton televisyen atau membaca.

- Lakukan senaman sederhana seperti berjalan laju, berbasikal dan berenang sekurang-kurangnya 60 minit, lima hingga enam hari seminggu.

- Jumpa doktor untuk mengenal pasti dan membetulkan masalah perubatan, biologikal atau fisiologikal yang berkaitan yang boleh menyumbang kepada berat badan yang berlebihan.

- Jumpa pakar pemakanan untuk mendapatkan maklumat tentang pengurusan berat badan anda.

- Dapatkan sistem sokongan. Rakan-rakan adalah kumpulan sokongan yang bagus.

Kesimpulan

BMI adalah indikasi bagi mengetahui berat badan ideal berdasarkan ketinggian kita.

Ia membolehkan kita mengetahui tahap kesihatan dan membantu kita mencapai sasaran terutamanya dalam menetapkan diet harian.

Namun, nilai BMI bukanlah satu-satunya cara untuk mendapatkan kepastian berkenaan risiko kesihatan sebenar anda.

Maka jika ada sebarang masalah kesihatan, jangan teragak-agak untuk berjumpa doktor bagi membincangkannya.